Insights

Asset-Based Credit (ABC): Easy As 1-2-3

December, 2024

Asset-Based Credit (ABC): Easy As 1-2-3

Asset-based credit (ABC) represents the next phase in the evolution of private credit markets. But what is ABC really all about? While the space can appear intimidating, we think asset-based credit is a powerful tool for private credit allocators that’s particularly worthy of consideration today.

In particular, we believe asset-based credit—which touches everything from how we make purchases, commute, pay for education, and much more—will be a strong source of favorable risk-adjusted returns in credit markets over the coming decade. At over $30T in size, the vast nature and relative complexity of the ABC market creates significant opportunities for experienced and scaled managers to exploit inefficiencies.

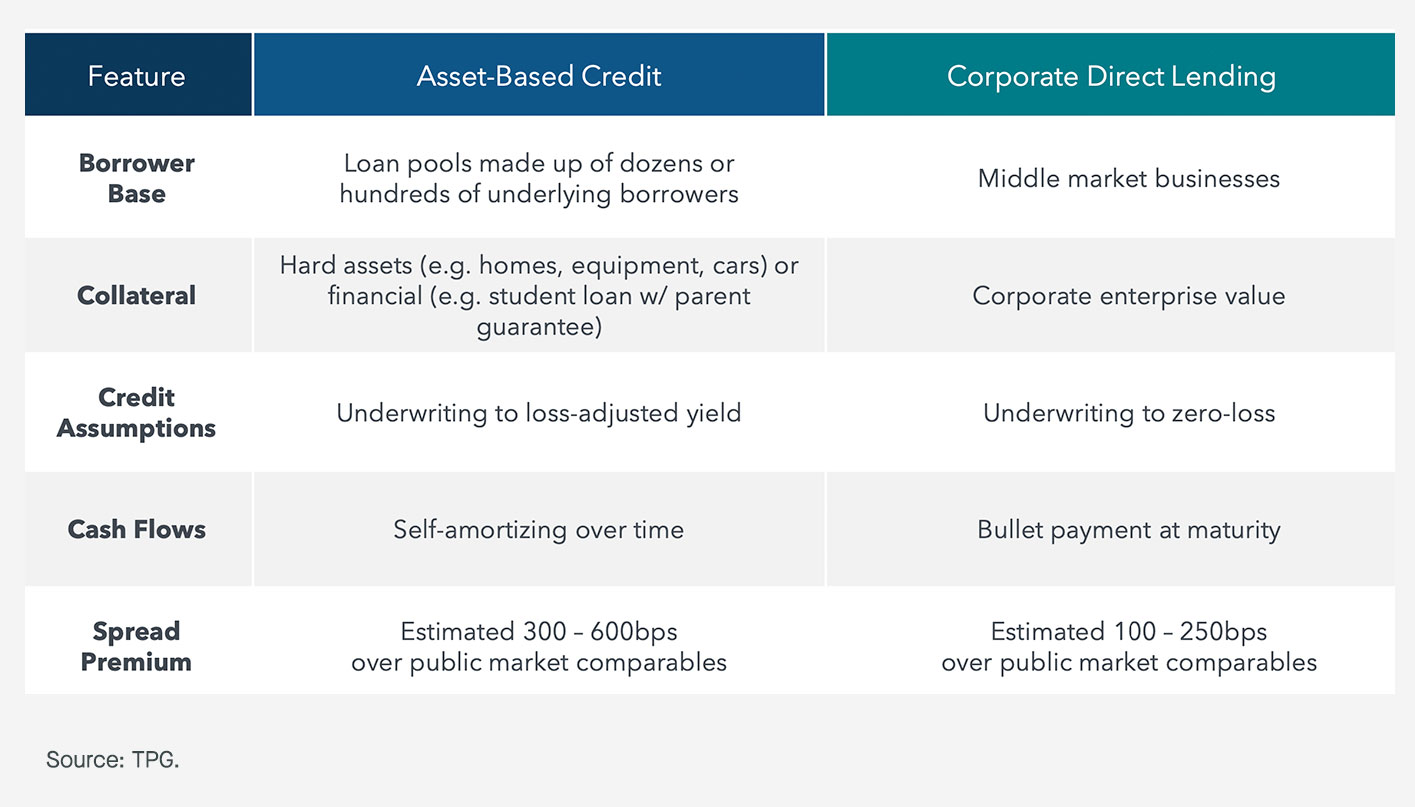

Additionally, asset-based credit provides investors exposure to an array of cash flows derived from a wide range of asset types, thereby offering attractive diversification to existing, “EBITDA-heavy” private and public credit allocations. The collateralization of ABC portfolios by diversified, front-loaded contractual cash flows from pools of underlying assets (auto, student, mortgage, and other loans) stands in contrast to corporate lending, which relies on the ability of a single operating company to service its debts via coupon payments and a large terminal maturity.

An Overview of Asset-Based Credit:

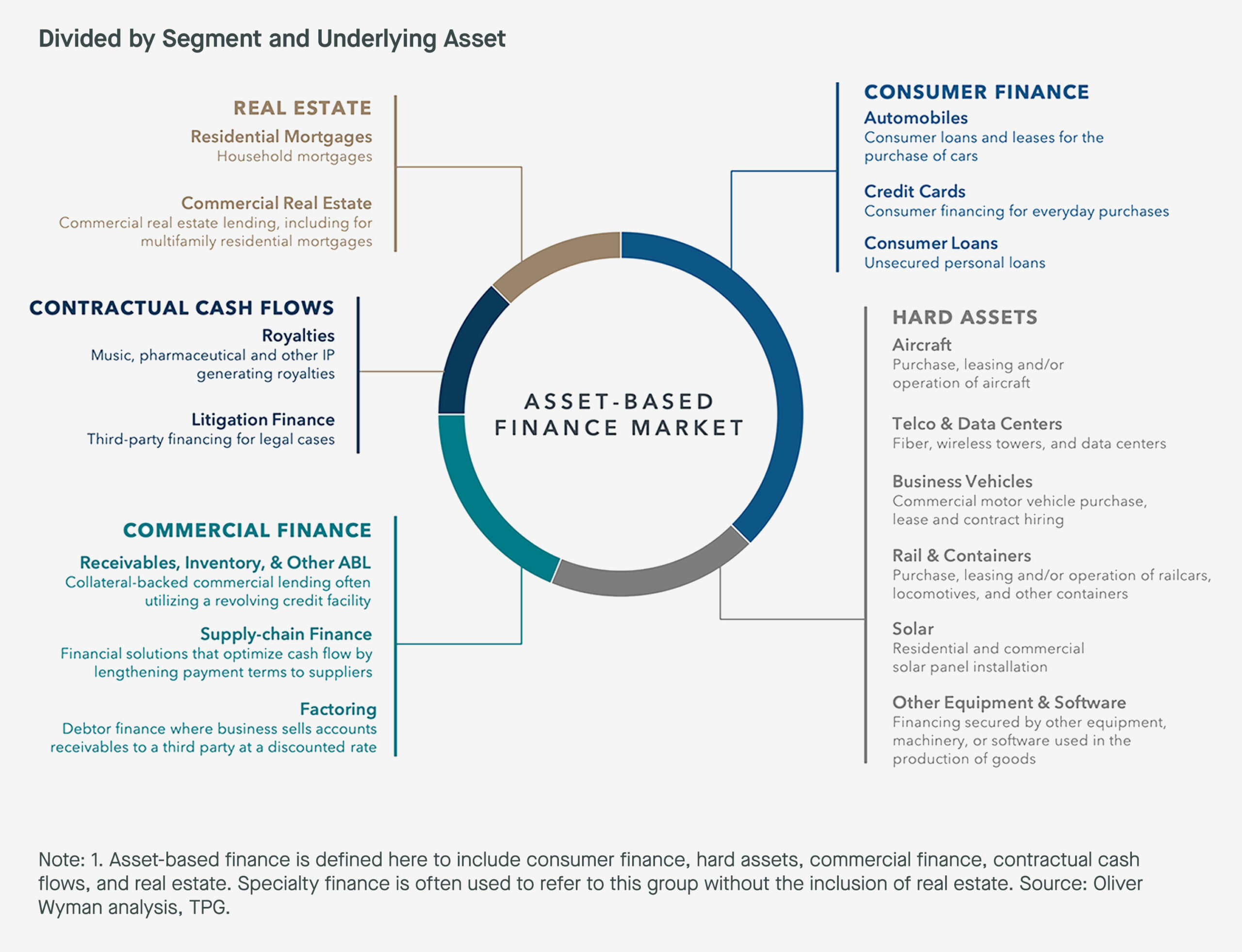

Asset-based credit is the financial fuel that powers millions of consumer, business, and other “main street economy” transactions every day.1 This includes providing credit to finance families’ mortgages, consumers’ purchases, business’ inventory, new home construction and development, and many more activities (see Exhibit 1). ABC thus empowers a wide range of stakeholders by providing debt capital to some of the largest segments of the global economy.

Exhibit 1: An Overview Of The Asset-Based Credit Market

The loans provided in asset-based credit are supported by the contractual cash flows from diversified pools of assets—such as mortgages, consumer loans, or payments receivable—that are then used for debt service (which amortizes over time) and pledged as collateral against the value of the loan (see Exhibit 2). This differs from corporate direct lending, where a lender’s collateral is a claim on a company’s enterprise value and recourse against a borrower’s other assets.

As with many parts of the private credit ecosystem, the growth of non-bank and specialty asset-based lending is in part a product of traditional banks pulling back from much of their conventional lending activity as a result of both market disruptions and increased regulatory constraints. This has left significant financing gaps that far exceed the sizable opportunity that already exists in private direct lending markets today.

The 1-2-3 of the ABC Opportunity:

#1. A Natural Evolution in Private Credit

Asset-based credit represents the next phase in the evolution of private credit markets. But at the moment investors have yet to fully appreciate this opportunity, in our view, and remain significantly underallocated.

The broad shift in lending away from banks is hardly a new phenomenon and has been underway for decades. With the increased focus on private credit in recent years, banks’ lending as a share of total borrowing in the US has been steadily declining for more than 50 years (from 60% in 1970 to 35% in 2023).

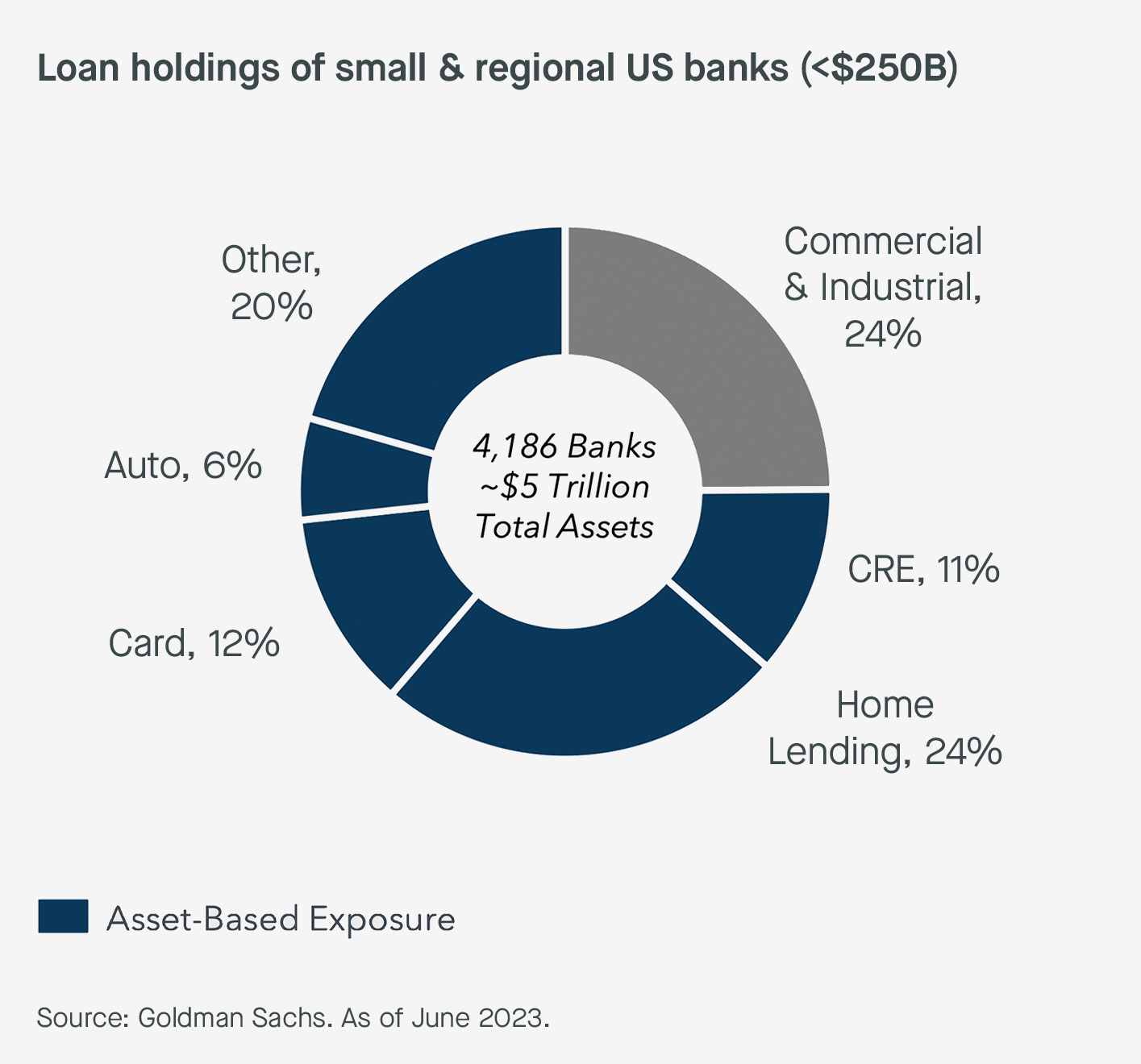

That said, previous waves of disintermediation have had less impact on asset-based credit markets, and ABC remains a staple of bank balance sheets. More than 75% of the loan holdings of both the largest banks and smaller regional banks in the US are comprised of non-corporate credit (see Exhibit 3).

Exhibit 3: ABC Is A Staple of Banks’ Balance Sheets

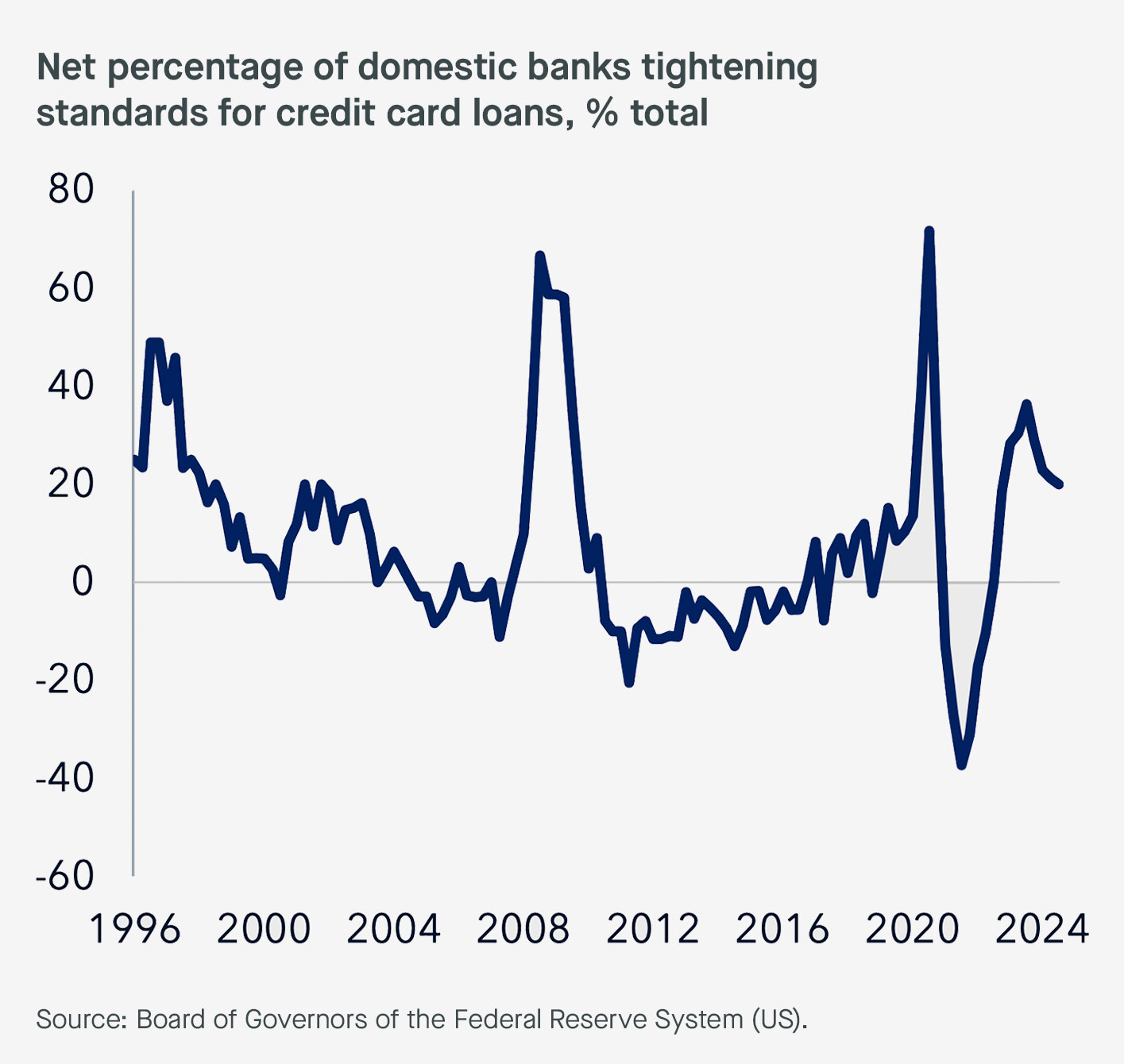

With lending standards continuing to remain tight across the US banking sector (see Exhibit 4), there’s a meaningful opportunity for much of this ABC lending activity to continue to migrate away from the traditional banks, as we’ve already seen play out in full force in the corporate credit space with the rapid growth of private market direct lending.

Exhibit 4: US Bank Consumer Lending Standards Remain Fairly Tight

#2. A Favorable Structure and Return Profile

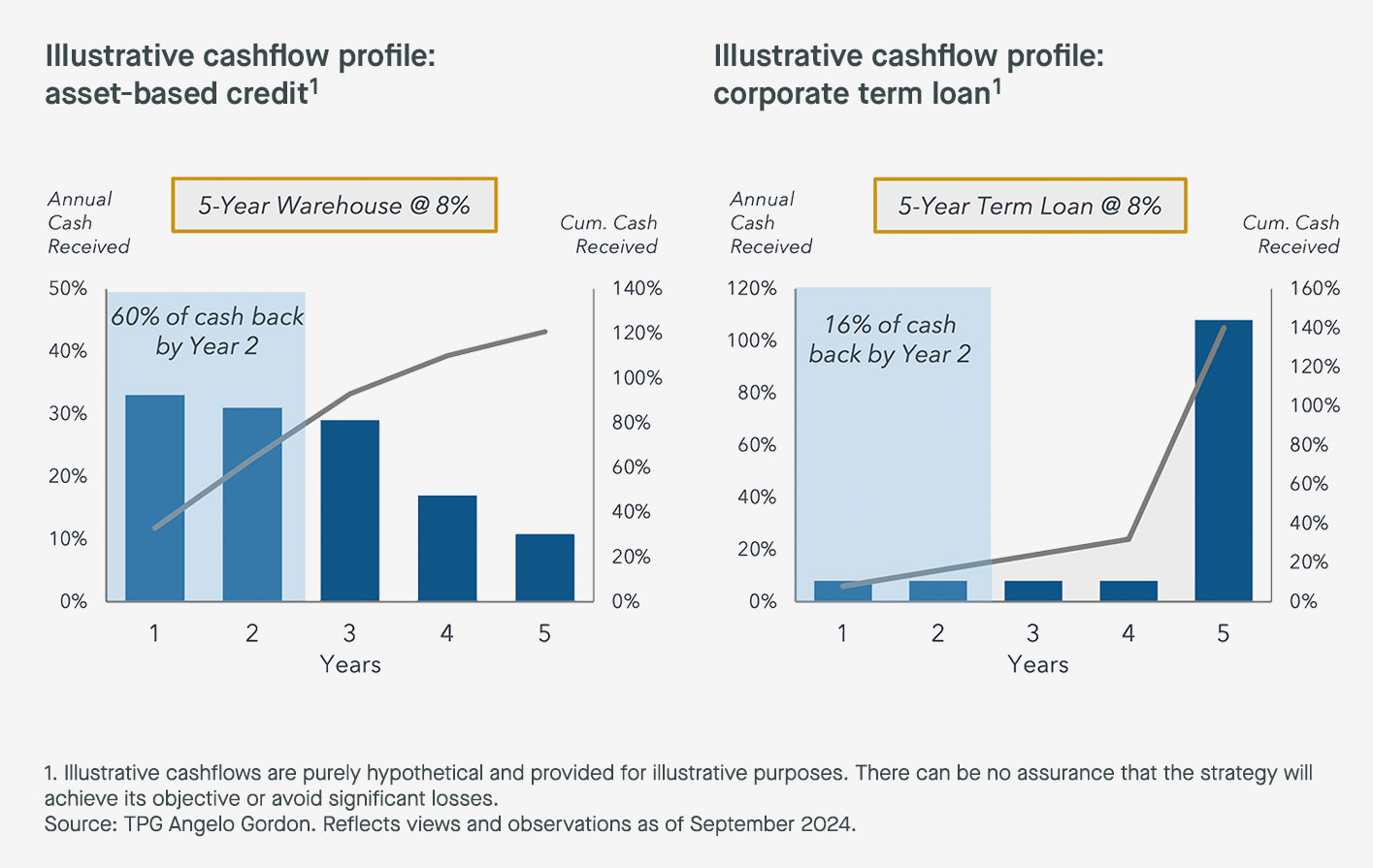

In addition to representing a sizable investment opportunity, asset-based credit can also offer highly advantageous structures and return profiles. In contrast to corporate credit, ABC exposures often have a “self-liquidating” profile where a majority of the cash flows are generated early in the life of the loan pool.

As a result, ABC debt often amortizes fairly quickly as the underlying loans that support it are paid off, which generates more front-loaded cash flows, shorter average duration, and lower long-term tail risk as a lender relative to corporate credit (see Exhibit 5).

Exhibit 5: Asset-Based Credit and Corporate Direct Lending Have Distinct and Complementary Cash Flow Profiles

Unlike corporate lending, investors aren’t exposed to rollover or refinancing risk in ABC. Asset-based credit also isn’t subject to so-called liability management exercises (“LMEs”), whereby a company modifies its existing debt, that have become common in corporate credit and can erode value for some creditors.

ABC structures often include covenants—such as debt coverage, collateral quality, and leverage tests—to protect lenders against any deterioration in borrower quality. To take one example, any deterioration in the collateral backing an ABC facility, such as a fall in house values, would require borrowers to post additional collateral to de-risk the loan pool.

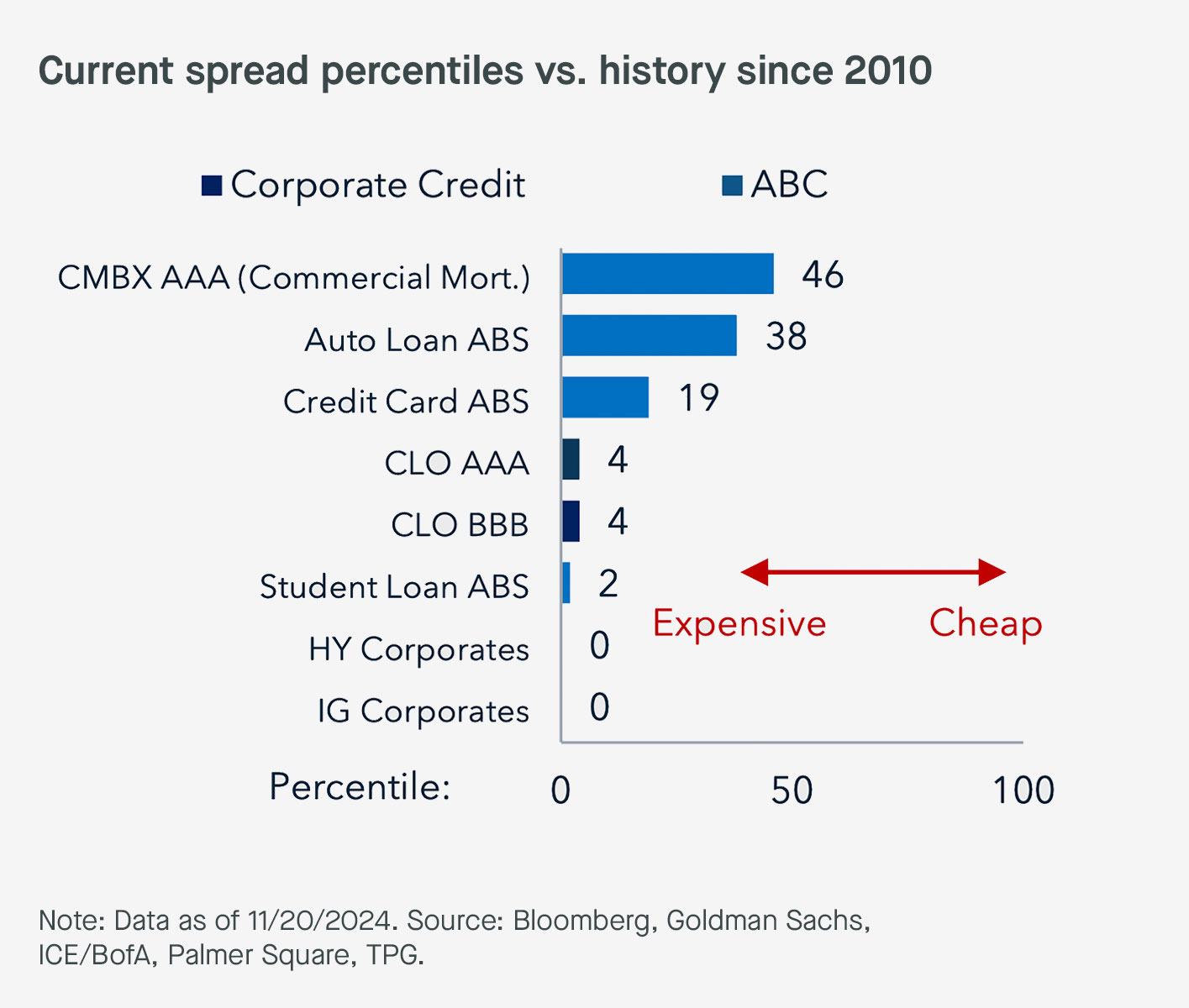

Amid the continued resilience of the US economy, credit spreads across the market have reached historic tights as the expectation for a “soft landing” has taken hold. Investment Grade (IG) and High Yield (HY) corporate credit spreads have never traded at more expensive levels (i.e., tighter spreads) since 2010 (see Exhibit 6).

Exhibit 6: ABC Offer Strong Relative Value Today

This has left asset-based credit as one of the few pockets across public credit markets with remaining relative value, at least at the index level, in our view. At the same time, the substantial variety across ABC markets, which encompass many different asset types and public as well as private market opportunities, means that investors can pick and choose where to play strategically based on a number of considerations, including spreads, underlying fundamental credit quality, technical supply/demand dynamics and more. As an example, a particularly strong opportunity exists in home equity lines of credit or “HELOCs” given near record-high overall home equity value across the US economy and the lock-in effect from higher mortgage rates (see callout box below).

Lastly, we think private market ABC provides a few important advantages relative to public market securitizations. Alternatives managers can operate with tighter controls in terms of origination and deal flow, providing a strategic advantage in terms of overall portfolio construction. They can also offer both originators and investors more certainty of execution relative to the public market, as well as capital solutions style “problem solving” when financing gaps materialize.

#3. Diversification

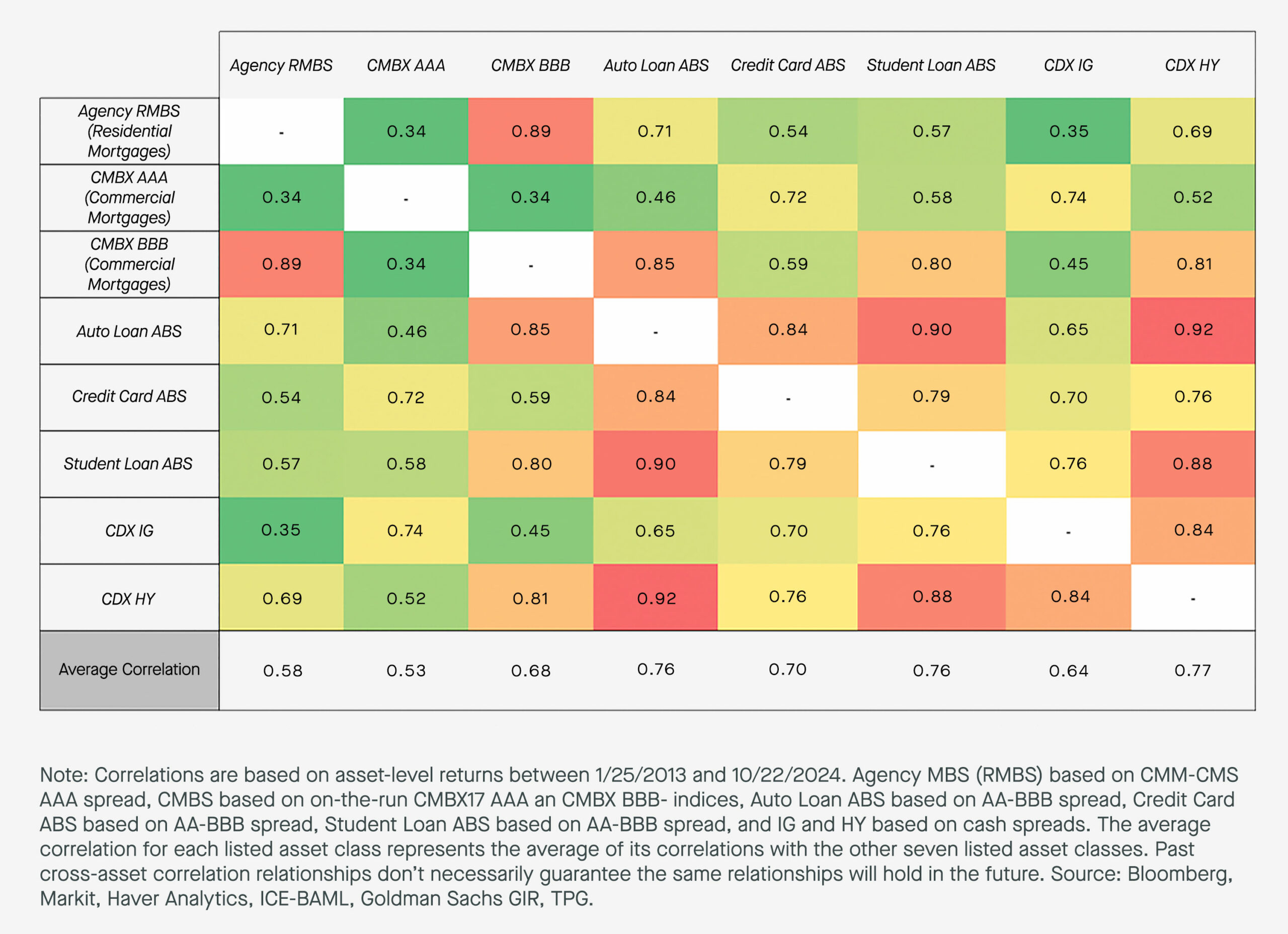

The asset-backed credit market provides a natural diversifier to the predominant economic and credit risk exposures associated with corporate direct lending, which has been the fastest-growing segment of the private credit market in recent years. With ABC, investors can gain access to cash flows driven by different parts of the economy in assets such as consumer credit, residential mortgages, and equipment finance, to name just a few examples, with distinct fundamental drivers that are complementary to corporate lending.

Given this asset type diversity, ABC markets have historically been less correlated with corporate credit (see Exhibit 7). Over time, we believe mature private credit portfolios should be more representative of the broader range of credit exposures that exist across the economy, including greater allocations to ABC.

Conclusion:

Asset-based credit markets represent a fast-growing and target-rich portion of the rapidly evolving private credit landscape. ABC touches many of the most critical activities across the economy and can thereby enable investors to participate in and benefit from their continued growth.

As private credit markets continue to mature and grow, we believe there’s a strong case for investors to consider adding allocations to ABC as a favorable source of risk-adjusted returns and diversification alongside corporate direct lending and other credit exposures.

Strategy Snapshot: Home Equity Lines of Credit (“HELOCs”):

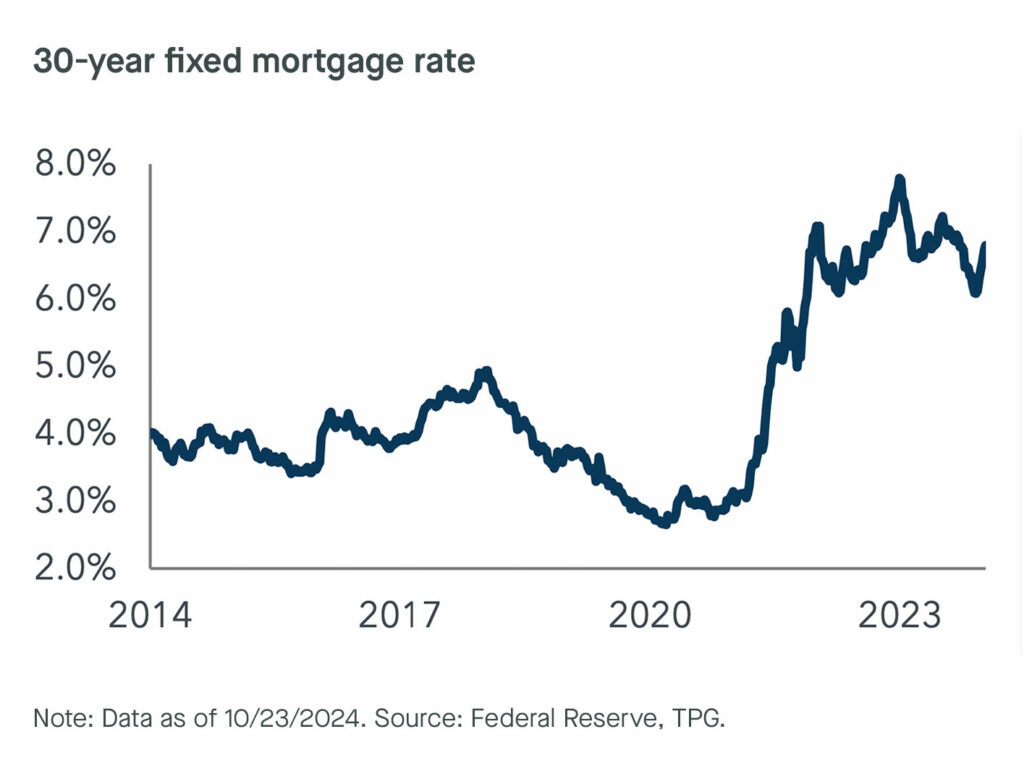

The outlook for one of the economy’s most rate sensitive sectors—housing—is in large part a product of the outlook for mortgage rates. While mortgage rates have fallen from their peak in late 2023, they remain far above the ultra-low levels experienced over the past decade (see Exhibit 8). Moreover, since mortgage rates incorporate forward expectations for future Fed easing, it isn’t immediately clear that we’re likely to see much additional downside in 2025 absent unexpected rate cuts.

Exhibit 8: Mortgage Rates Remain Elevated Today

One impact of recent high mortgage rates has been a significant increase in the financial cost of moving for existing homeowners—leading to the so-called “lock-in” effect, whereby homeowners have become reluctant to move due to the cost of having to prepay their existing mortgage and take on a new one at a much higher rate. Around 85% of mortgage borrowers today have interest rates below those prevailing in the market.

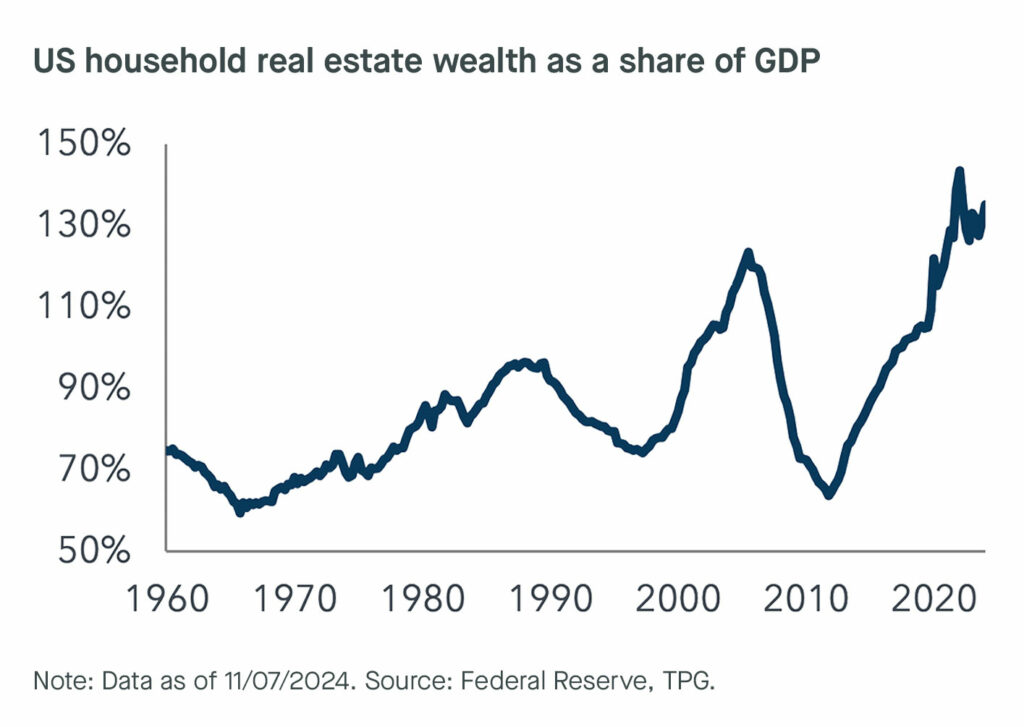

At the same time, national home price appreciation has remained fairly strong, averaging around 3.5-4%, and total home equity is near all-time highs at around 135% of GDP (see Exhibit 9).

This combination of homeowners being locked into their existing homes and sustained home price appreciation has generated a strong incentive for households to tap home equity lines of credit (HELOCs) for things such as home improvement or other discretionary and non-discretionary spending.

Exhibit 9: US Home Equity Is Near All-Time Highs

HELOCs can provide a useful source of liquidity for households and, given they are secured in nature, their cost is often preferable for borrowers relative to paying significantly higher interest rates on unsecured consumer loans or credit cards.

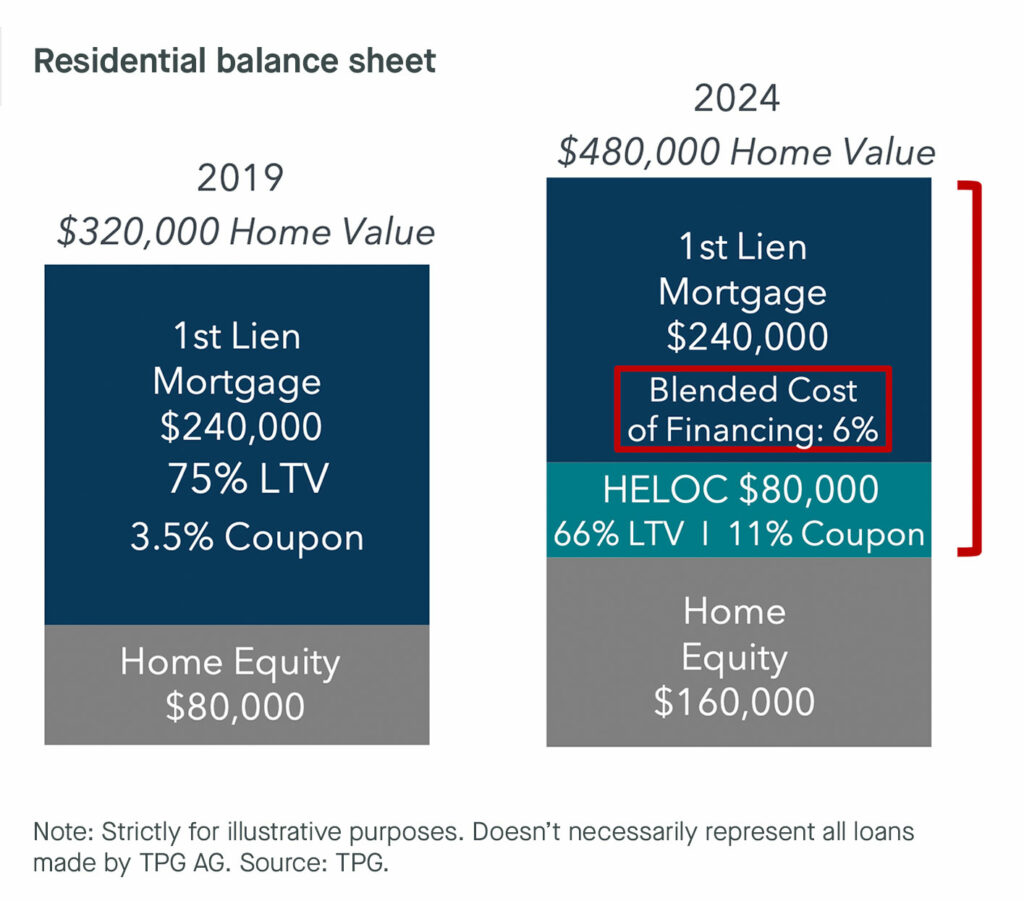

As a lender, providing capital for HELOCs also has many attractive features. In particular, such transactions can provide high carry relative to a first-lien mortgage while also still affording a lender downside protection in the form of the collateral of the underlying home (see Exhibit 10).

Exhibit 10: A Snapshot of Home Equity Lines of Credit

The strong opportunity in home equity line of credit (HELOC) lending is a great example of the important role that ABC can play in helping to solve everyday household financing challenges while providing value to both the borrower and the lender.

Disclosures

This white paper is provided for educational and informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The contents hereof should not be construed as investment, legal, tax or other advice.

This white paper, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of TPG Global, LLC (together with its affiliates, “TPG”).

Certain of the information contained herein, particularly in respect of market data, economic and other trends, forecasts and performance data, is from third-party sources. While TPG believes such sources to be reliable, TPG has not undertaken any independent review of such information.

Unless otherwise noted, statements contained in this white paper are based on current expectations, estimates, projections, opinions and beliefs of TPG professionals regarding general market activity, trends and outlook as of the date hereof. Such statements involve known and unknown risks and uncertainties, and undue reliance should not be placed thereon. Neither TPG nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance.

If you believe any content, branding, information or other material incorporated into this white paper has been included in violation of applicable law, agreement, or other restriction, or that any other portion of these materials is otherwise improper, please notify us at compliance@TPG.com.

TPG

345 California St suite 3300, San Francisco, CA 94104, USA