March 2025, Issue #10

Flywheel in Focus: Value-Centric Healthcare

Themes are central to what we do at TPG. Our longstanding commitment to opportunity development, rooted in sectors we know well, shapes the insights that allow us to see around corners and drive continuity across our strategy over time. This approach has enabled a powerful ecosystem – a flywheel – that gives us a competitive advantage in the market.

Introducing: Flywheel in Focus

In our new series of The TPG Take x Flywheel in Focus, experts from across the firm provide deep dives on the enduring themes that enable our investment strategy. In this edition, we explore the shift in healthcare towards Value-Centric Care – delivering high-quality care at a lower cost – and how we’re investing behind this theme to lead to better outcomes across the healthcare sector.

What is Value-Centric Care?

John Schilling: "The U.S. healthcare market is about a $4 trillion market, and anybody that has spent time in that market recognizes that it is incredibly inefficient. Inefficiency actually creates opportunity. Our view is that if you're delivering high-quality care at a low cost, regardless of what the broader economic market looks like, that's going to be an attractive opportunity."

Jeff Rhodes: "Value-centric care is the way that we've thought about investing behind providers. There's an intense need for this within healthcare, as there are legacy providers that are inefficient or have reimbursement models that are focused on providing more care, rather than better care. We're intensely focused around patient outcomes and, wherever we can, focusing in complex patient areas that have been historically underserved."

How has the theme evolved and how do we invest behind Value-Centric Care?

Zach Ferguson: "One of the key themes for us has been the site-of-care shift toward lower acuity settings – moving care from what was historically done within a hospital, to an outpatient setting, or, in some cases, to a patient's home."

Kendall Garrison: "We've invested behind that shift through SCA, our ambulatory surgery platform. We've extended that further by investing in home health with Kindred at Home. More recently, we backed a platform called OneOncology, which is the largest management services organization for community oncologists in those practicing outside of the hospital."

Jeff: "We're also focused on models that align around reimbursement. We have a number of investments in value-centric care that are totally aligned around making sure that the reimbursement to the provider is oriented around getting the right outcomes for patients and the right patient experiences. Those would be examples of businesses such as Kelsey-Seybold or OneOncology."

Zach: "During COVID, supply chains in all industries became more in focus. Healthcare certainly was part of that, and it shone a light on challenges that are created when it's not running efficiently. And so we've looked for investments that add analytics and capabilities to the healthcare supply chain as a better way to track its performance."

TPG's Differentiated Approach to Value-Centric Care

John: "Our goal is to build great companies. What that means for me is to focus on both performance and health. So how do we know that the company is going to grow sustainably for a long period of time? It requires investment in things like capabilities of the company, the people, the R&D – all of the resources that are necessary to ultimately drive long-term, sustainable growth."

Jeff: "We've been investing behind value-centric care for almost two decades, so it's an area that we know well. Over that time, we've built up deep relationships with all players in these ecosystems, and it's enabled us to really work closely with companies and help them achieve their full potential."

John: "One way that we try to express our themes is in the form of corporate partnerships. We've done a huge amount of work to understand the needs of different constituents across the value chain in healthcare. A big part of what we're trying to do is understand the problems they face, and how we can partner with them to collectively solve their problems, but also address the broader set of problems in healthcare."

Kendall: "Given the amount of complexity that exists in the healthcare system – from the changing reimbursement dynamics to governmental dynamics – the strategics in the space are increasingly going to need help. And I think that plays really well into our core focus on corporate partnerships and carve outs. I think we can really help drive change where it might otherwise be difficult."

Zach: "Go Health is a good example. We invested in a very small business and brought in a great CEO that we believed could help transform this business and create a much more innovative company than what we invested in. We did this in a joint venture partner model where we are partnering with large, market-leading not-for-profit health systems in 50/50 joint ventures to build urgent care clinics, to do virtual care, to provide care to schools and directly to employers within these markets. Fast forward to today, we've built over 200 de novo urgent care centers and provide care to over 3 million patients annually."

Looking Ahead

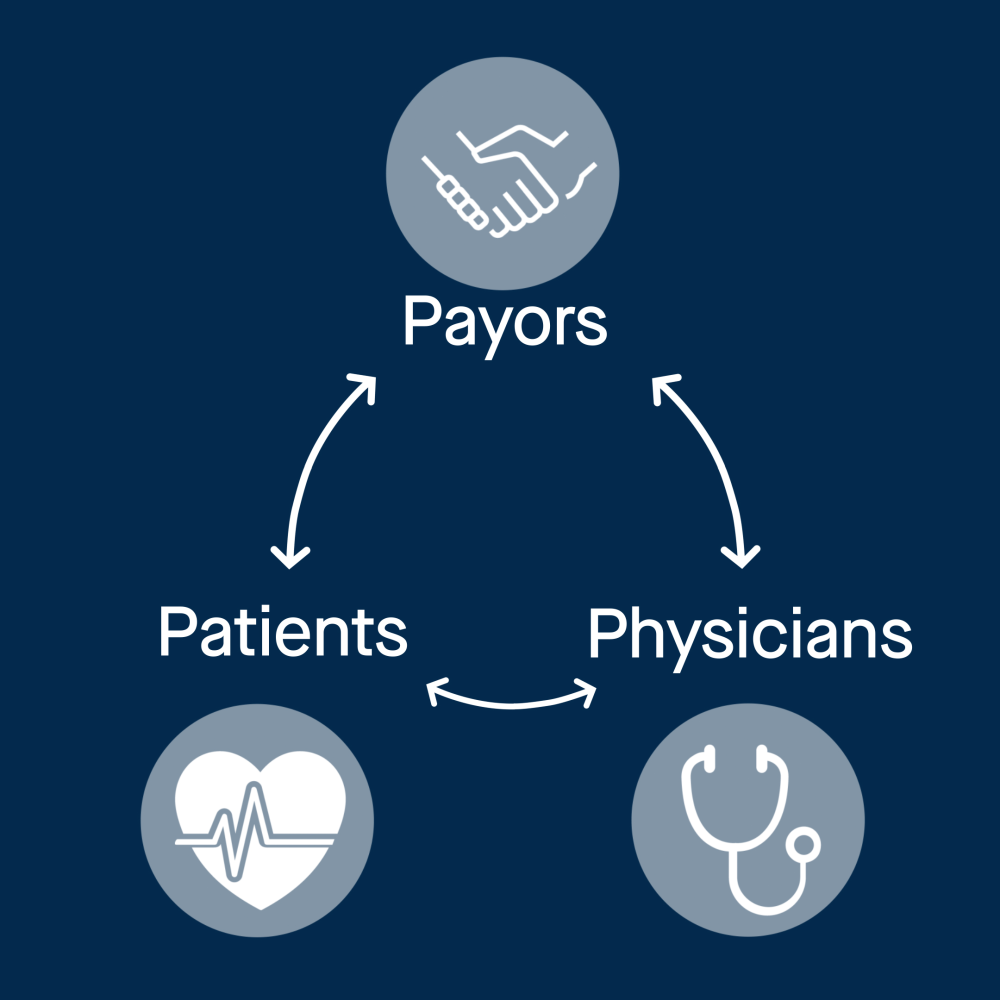

John: "Over time, what I would expect is greater alignment between the payors, the patients and the physicians. When you align those interests, ultimately what you get is high-quality care at lower cost."

Jeff: "I think that the need for providers who are focused on value-centric care is only growing. We've found that this is continuing to generate very attractive investments for us that are creating companies that we're very proud to be associated with."

Disclaimer: Statements expressed in the videos and text above are based on expectations, opinions, and/or beliefs of TPG as of June 12, 2023 and October 21, 2024 and may be subject to change, they should not be construed as research or investment advice. Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness.

In Other News & Views...

As usual, we also want to "circle back" to share other recent insights from our ecosystem, senior leaders, and investing professionals that you might have missed.

In our series Partnerships in Focus, we hear directly from leaders across the TPG portfolio and ecosystem. In the latest episode, Jeff Patton, MD, CEO of OneOncology discusses how TPG’s ecosystem, experience, and breadth of resources has been critical to their mission to support the future of cancer care through a patient-centric, physician-driven, and technology-powered model.

Thank you to all of our followers and readers for joining us for another edition of The TPG Take. Please share the newsletter with anyone you think would be interested and we look forward to being back in your inboxes.

TPG

345 California St suite 3300, San Francisco, CA 94104, USA

Important Disclosures

This material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The opinions expressed herein represent the current, good faith personal views of the author(s) at the time of publication, and do not necessarily represent the views of TPG, its affiliates, or any of its investment professionals. The opinions expressed herein are not definitive investment advice and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, TPG does not guarantee the accuracy or completeness of such information. We provide links to third party websites only as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. If you choose to visit the linked sites you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies, over which TPG has no control. In no event will TPG be responsible for any information or content within the linked sites or your use of the linked sites. Predictions, opinions, and other information contained in this material are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made, and TPG assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.