Insights

Real Estate Credit: Poised to Outperform

December 2024

Real Estate Credit: Poised to Outperform

The outcome of the US election and anticipated policy shifts have raised the prospect for a more reflationary environment and persistently elevated interest rates in coming years. For the real estate credit market, this comes following an already challenging period of higher borrowing costs and contracting credit availability as banks and traditional real estate lenders have rapidly pulled back from new lending activity.

One consequence of the ongoing dislocation in real estate credit markets is that there’s perhaps never been a better moment to be a real estate lender given the acute need for real estate capital to right-size the debt loads of high-quality properties with broken capital structures.

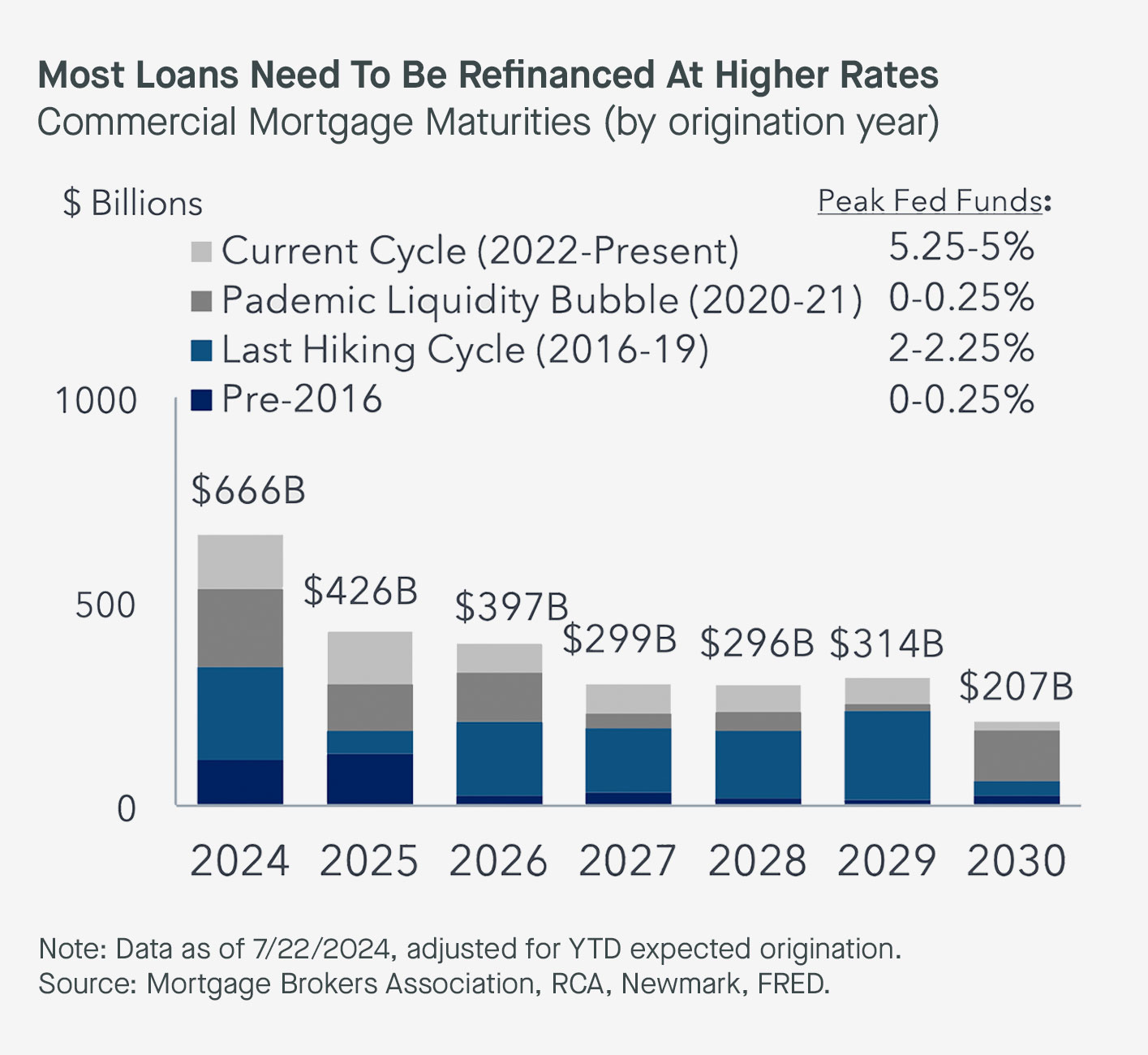

At the same time, the pullback of many financial institutions from new lending activity has created significant financing gaps that likely can only be filled by private market investors stepping in. More than $570B of commercial mortgages are set to come due in 2025, and many will need to be refinanced at far higher rates and lower proceeds than are currently in place.

Four Forces Strongly Support Private Real Estate Credit:

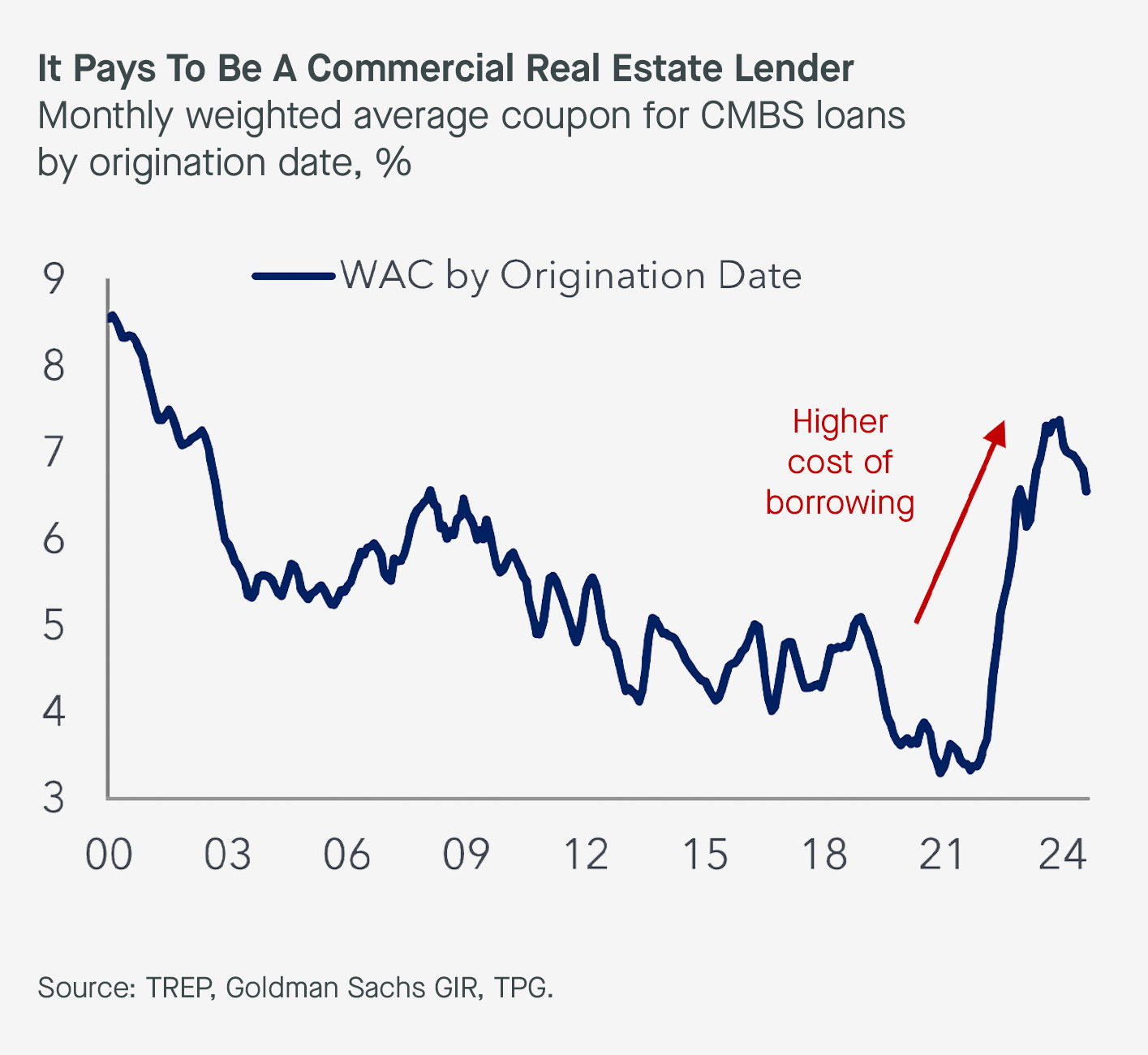

First, interest rates remain elevated relative to recent history despite the start of the Fed’s cutting cycle, which means you’re simply getting paid more to be a lender today. Additionally, as the yield curve flattens as the Fed gradually eases policy, a higher cost of borrowing can persist whether benchmarked off the front or back end of the interest rate curve.

We expect these rates will settle far above the abnormally low levels investors had become accustomed to following the Global Financial Crisis (GFC), contributing to higher financing costs in CRE markets (see Exhibit 1).

Exhibit 1: CRE Financing Costs Have Risen Sharply

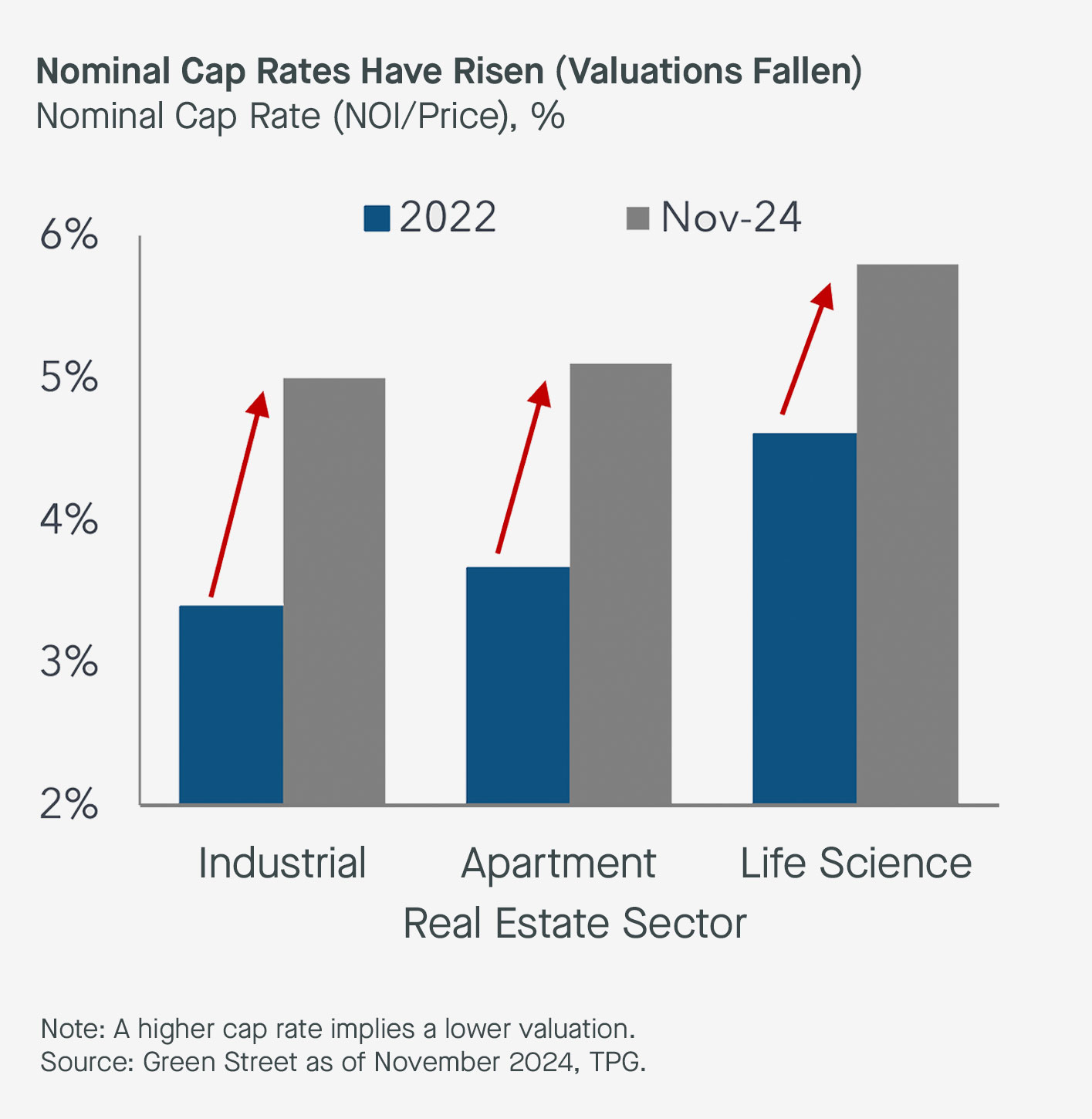

Second, the reset in real estate valuations provides additional downside protection for real estate lenders. As interest rates have normalized from near-zero levels, properties that were previously financed in a low-rate environment are being revalued and recapitalized at lower leverage levels (see Exhibit 2).

Exhibit 2: Valuations Remain Far Below Their 2022 Peak

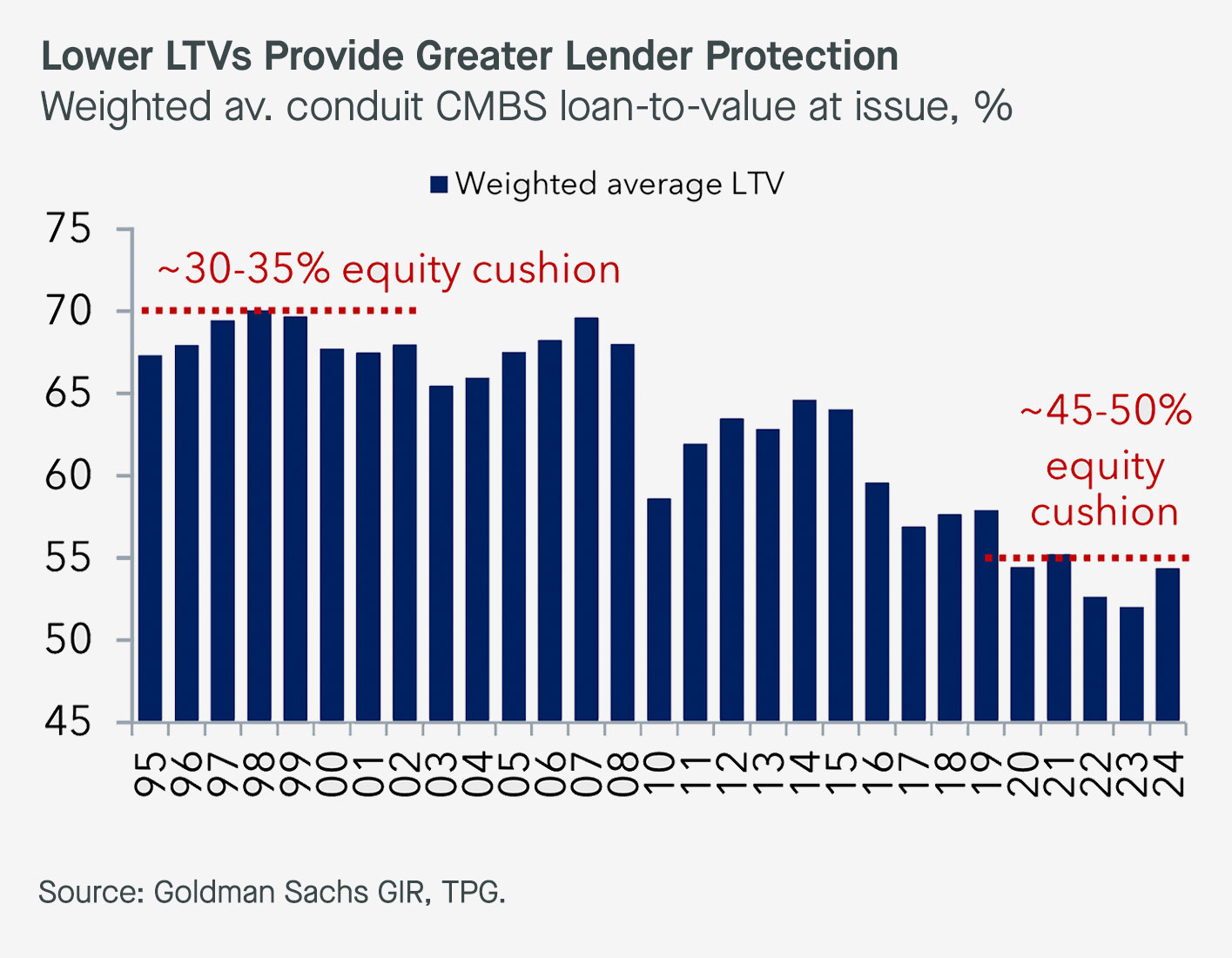

The reset in valuations has coincided with tightening underwriting standards such that lenders are generally able to provide capital with a larger equity cushion relative to a property’s overall value, thereby limiting potential downside (see Exhibit 3).

Exhibit 3: Loan-To-Value Ratios Have Declined

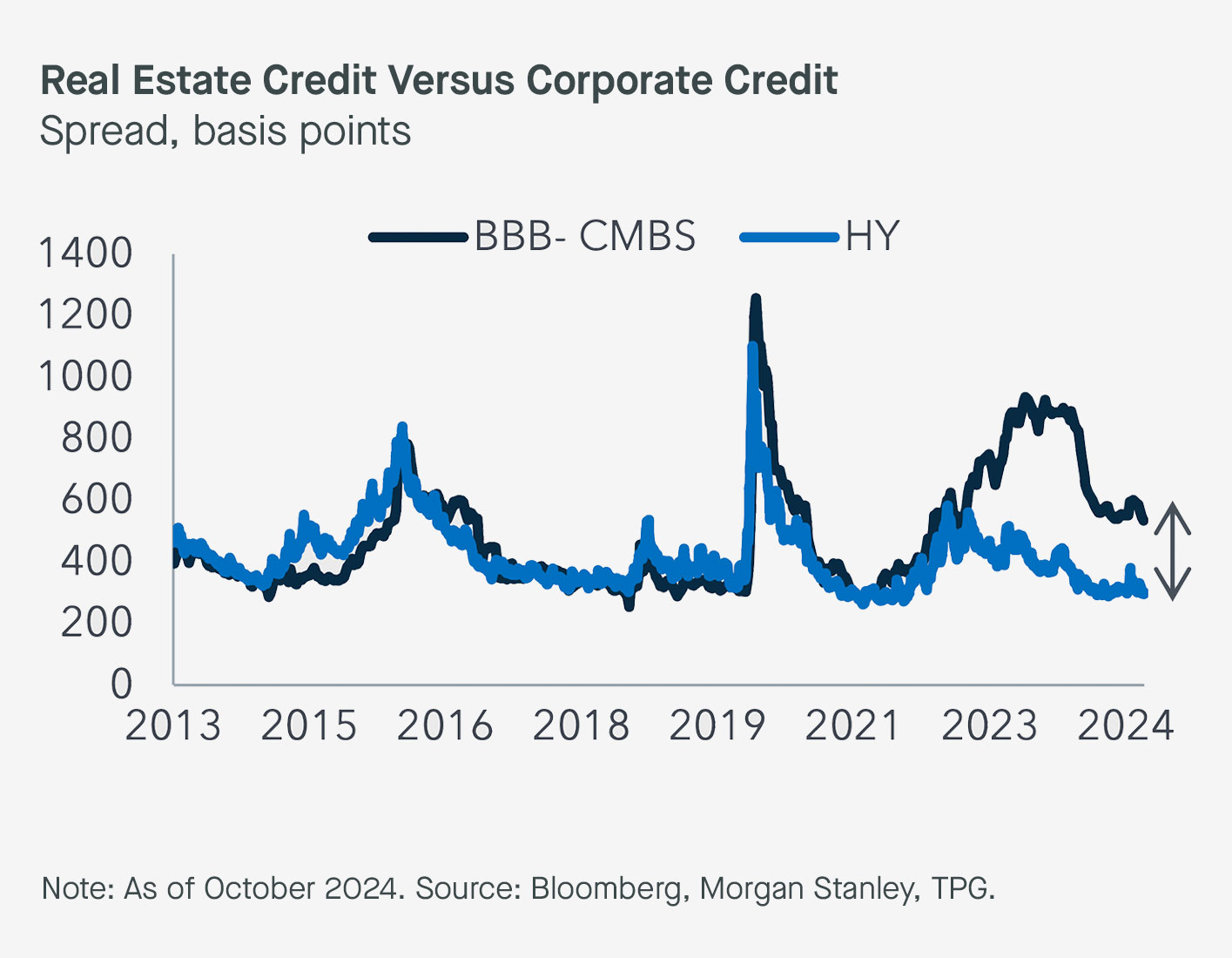

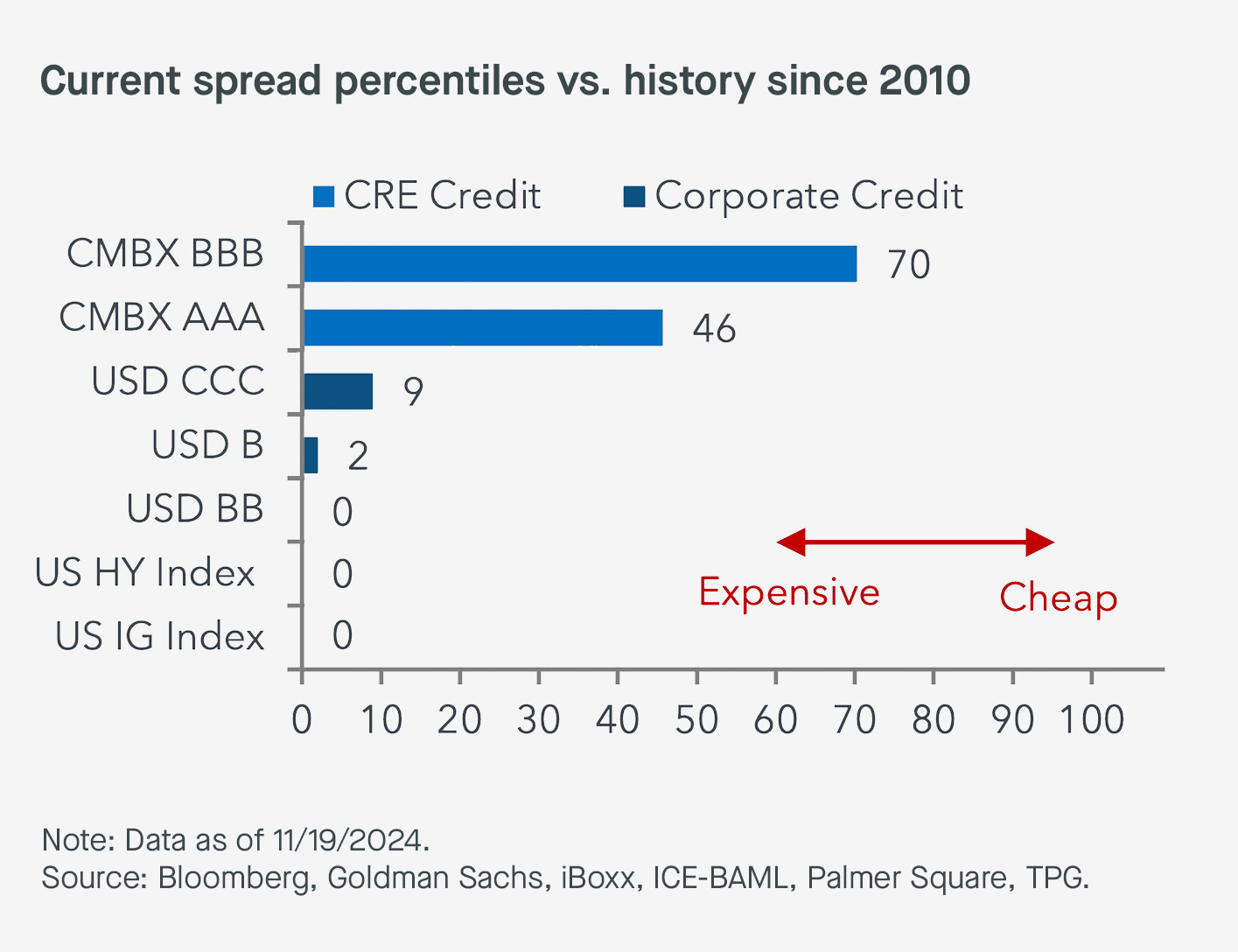

Third, a significant decoupling between real estate credit and corporate credit spreads has increased the relative attractiveness of CRE lending. Spreads in these markets are typically highly correlated, but a sizable gap opened as the Fed began to raise interest rates in 2022 and persists today (see Exhibit 4).

Exhibit 4: Diverging Real Estate & Corporate Spreads

One aspect of this divergence is that corporate credit markets are trading at historic tights on a spread basis (see Exhibit 5). We believe that’s in part due to the massive influx of capital into private credit, which has raised competition among lenders and brought down the cost of capital in public credit markets.

Exhibit 5: RE Credit Offers Favorable Relative Value

In contrast, a similar inflow hasn’t occurred in real estate credit. At the same time, commercial real estate is experiencing a slow-motion property recession across certain property types, while corporate credit hasn’t seen comparable systemic distress in 15 years.

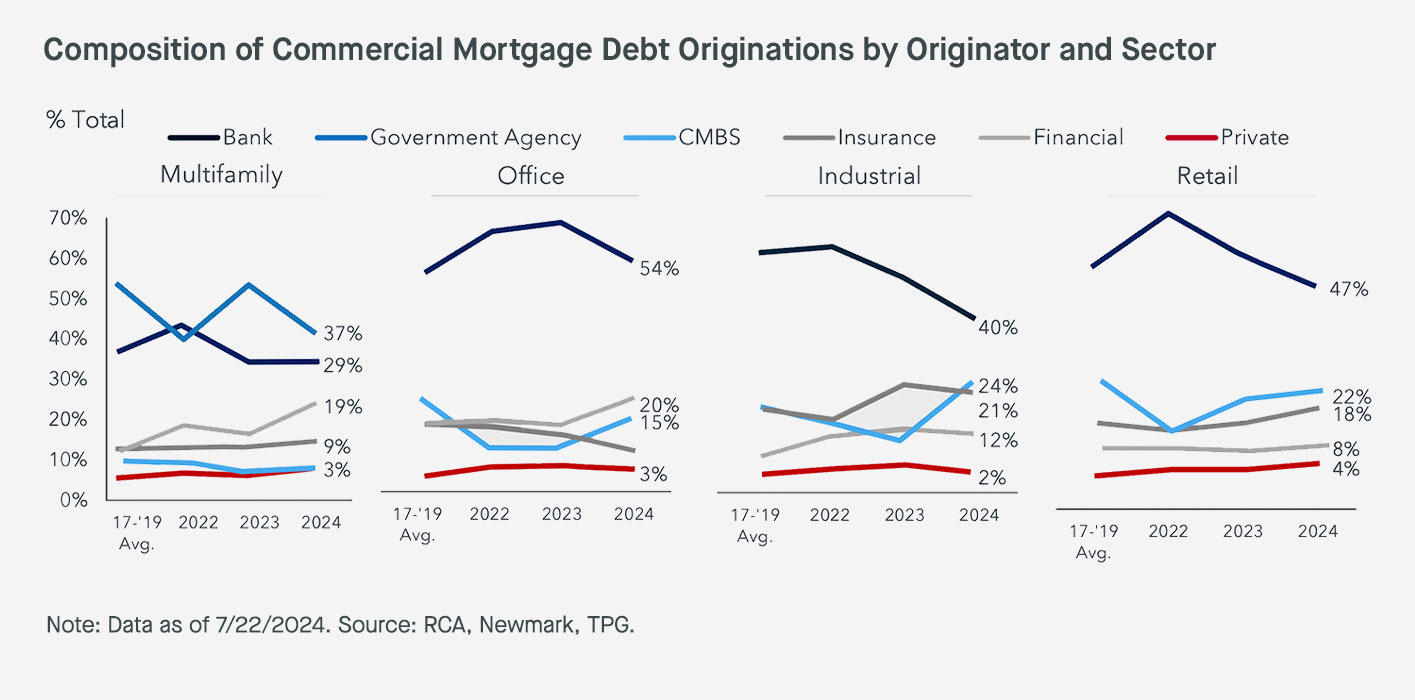

Fourth, the rapid transition to higher funding costs and resulting CRE market stress has caused banks and other traditional CRE lenders to pull back while a sizable maturity wall of about $2T in US CRE debt needs to be refinanced between now and 2026. The number of active commercial real estate lenders has declined by more than 30 percent over the past year, raising the question of who is best positioned to fill the void.

More than 40% of CRE mortgages sit on banks’ balance sheets, and we’re starting to see more evidence that their share of new CRE loan originations is beginning to fall (see Exhibit 6).

Exhibit 6: Banks’ Share Of CRE Lending Is Beginning To Fall, and Private Markets Are Poised To Step In

Insurers and the securitized product market represent two possible alternative sources of CRE lending capital. But life insurers’ CRE debt allocations are already nearing record highs, and any increase in the share of securitized markets will depend on the ability of non-agency CMBS to attract new investors.

Ultimately, we believe private market funds have a critical role to play given the sheer magnitude of the financing gaps across CRE markets, which includes ~30% of maturing CRE loans that were originated at record-low rates during the pandemic liquidity bubble (see Exhibit 7).

Exhibit 7: ~1/3 of Maturing CRE Mortgages Were Originated At Record-Low Rates

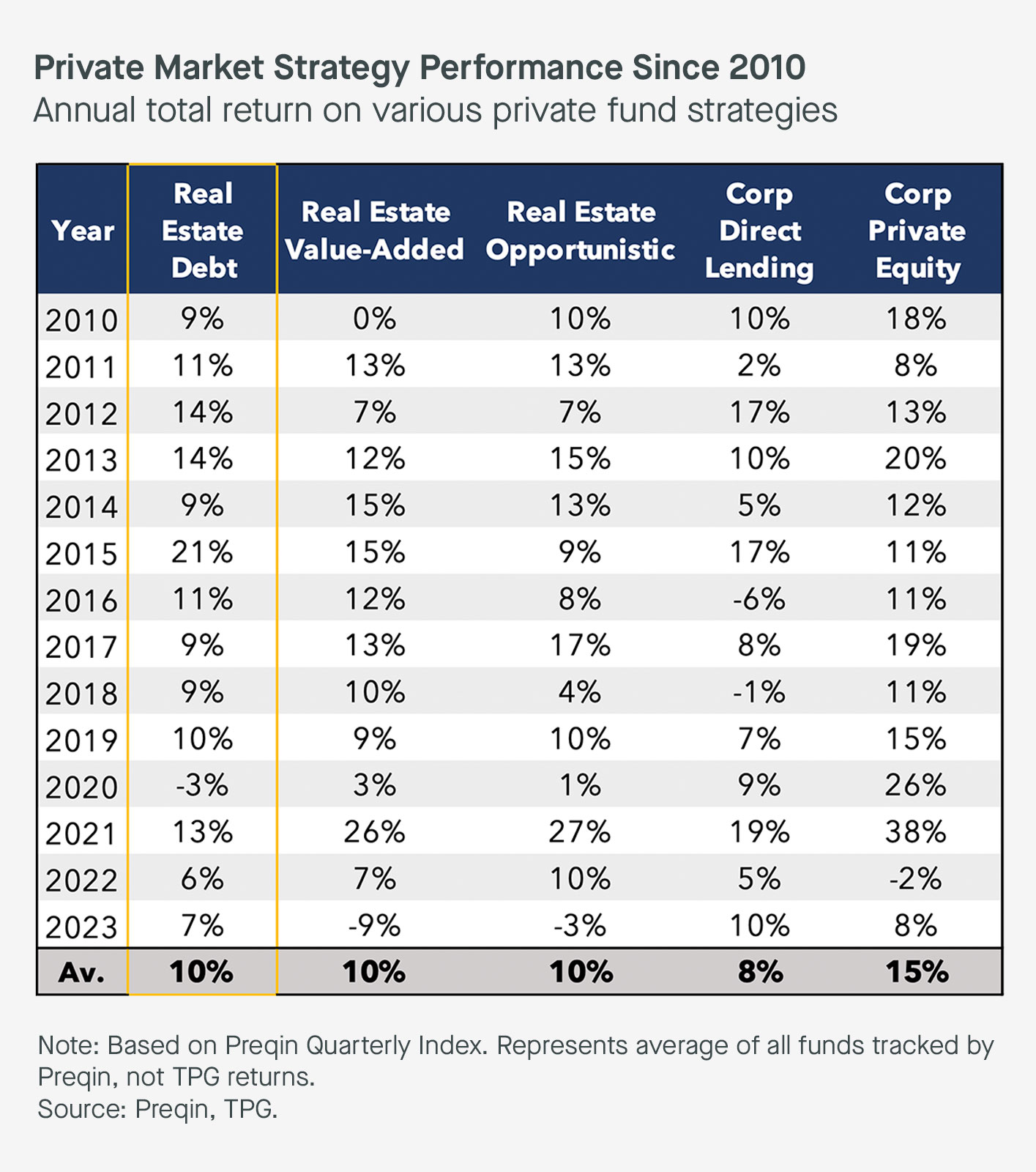

The scale of the ongoing dislocation in real estate lending markets leaves ample room for private market credit funds to step in to provide capital at attractive yields. Private real estate credit returns compare favorably with those of other private market strategies over the past decade-plus (see Exhibit 8), and we see significant opportunity for outperformance in today’s highly advantaged environment, particularly for platforms with scale, a flexible mandate, and the ability to remain selective.

Exhibit 8: Real Estate Debt Fund Performance Compares Favorably With Other Private Market Strategies

Conclusion:

The recovery of commercial real estate markets following the most aggressive Fed hiking cycle in more than four decades will likely take several years to fully play out. As the process of revaluation and recapitalization unfolds, we believe private market lenders will play a critical role in providing essential real estate credit capital. We expect this will help to drive attractive returns given a likely combination of acute capital needs and a scarcity of supply from traditional real estate credit providers.

A Summary of Why We Like

Opportunistic Real Estate Credit:

#1. Elevated Borrowing Costs

#2. Reset Valuations Provide Additional Protection

#3. Attractive Risk-Adjusted Returns On An Absolute & Relative Value Basis

#4. Bank Pullback Creates Capital Gap & Long-Term, Scalable Opportunity Set

Disclosures

The information contained herein is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy any security. Such an offer may only be made by means of the definitive Confidential Offering Memorandum of a specific TPG Angelo Gordon fund and will be made exclusively to investors satisfying the applicable eligibility criteria.

The information contained herein may not be reproduced in whole or in part without the prior written consent of TPG Angelo Gordon.

Certain statements contained herein reflect the subjective views and opinion of AG which may not be able to be independently verified and are subject to change. Data and views presented are as of the date hereof unless otherwise indicated and are subject to change without notice. Certain information has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, TPG Angelo Gordon has not independently verified such information and makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain information regarding economic and market conditions contained herein has been obtained from published sources and or prepared by third-parties and in certain cases has not been updated through the date hereof. All information contained herein is subject to revision and the information set forth herein does not purport to be complete.

Certain information contained in this presentation constitutes “forward-looking statements” that can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any TPG Angelo Gordon investment may differ materially from those reflected or contemplated in such forward-looking statements.

TPG

345 California St suite 3300, San Francisco, CA 94104, USA